The Federal Reserve, aka the Fed recently celebrated 107 years as the central banking system of the United States and over that time 16 governors have served as Fed Chairs. Many presided over some of America’s most economically stressful times, from the Great Depression to Black Monday and most recently the Financial crisis of 2008 and 2009. Each one guided the financial markets in their own unique way, Greenspan’s “fed speak” and “irrational exuberance” to Janet Yellens’ ability to drum up some fairly verbose testimony. Their words often drove markets, not just in times of crisis, but over a 30 year period studied in this post, the derived sentiment signal showed a modest correlation to equity markets.

I parsed recent statements and minutes from 1980 through 2010 using NLTK and spaCy natural language processing and applied sentiment analysis to uncover some interesting trends.

To do this, I applied sentiment analysis to the words in the documents using the Loughran-McDonald financial dictionary and assigned a positive or negative value to those words that fit the financial services context.

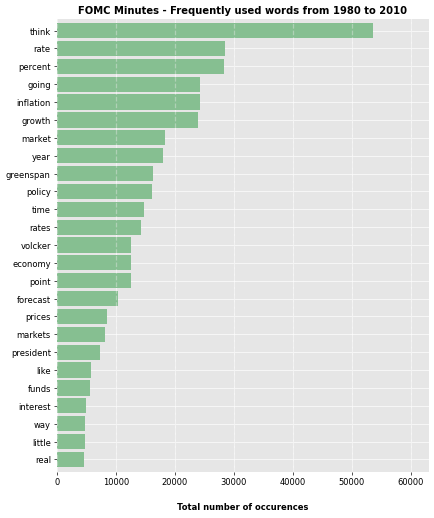

Parsing through 30 years of FOMC (Federal Open Market Committee) meetings minutes, which includes roughly 8 meetings per year is made easy. Most processing was quick in the first 2 decades although the transcripts from 2000 till 2010 saw a dramatic reduction in efficiency and those documents were indeed nearly twice as long, particularly those from 2008 and 2009(can’t imagine why). In a future analysis, I plan to review the trends of the top words over time. In the chart below the focus was on the entire corpus of transcripts and what I found somewhat “thought” provoking was the run-away most frequent word in these documents. Reassuring to know our nation’s finest financial wizards are always “thinking.”

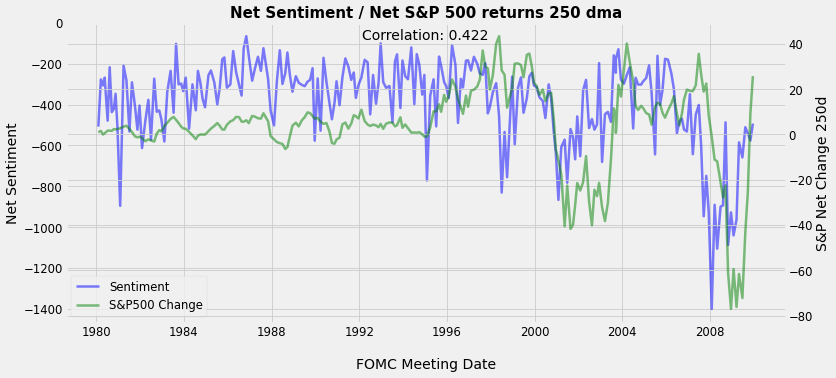

We can also track the sentiment produced from mapping to the financial lexicon described above and how the sentiment changed during the tumultuous historical periods highlighted below.

The sentiment signal created over the 30 year period tracked fairly well. While both time series were differenced, that is to say the differences between their consecutive observations was computed in order to remove their trends and allow for comparison, there are many forces at play that kept our sentiment from reflecting a greater explanatory power and yield a greater correlation than the 42% witnessed in this study.